27+ Ohio Take Home Pay Calculator

The process is simple. Use ADPs Ohio Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Washington Court House Apartments 861 Kohler Drive Washington Court House Oh Rentcafe

All you have to do is enter each.

. How much do you make after taxes in Ohio. Luckily our payroll calculator is here to help you avoid any payroll tax fiascos. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The take home pay is. Whether you use our calculator or do your own payroll accurate information is crucial. The hourly and salary calculator for Ohio relies on a few crucial pieces of information.

This Ohio hourly paycheck. Can be used by salary earners self. Ohioans pay state-level income tax ranging from 0 to 399 depending on their taxable incomes.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. Supports hourly salary income and multiple pay frequencies. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Try our Ohio payroll calculator. For example if an employee earns 1500 per week the individuals. Your average tax rate is 1198 and your marginal tax rate is 22.

Just enter the wages tax withholdings and other information required. This free easy to use payroll calculator will calculate your take home pay. Need help calculating paychecks.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ohio Hourly Paycheck and Payroll Calculator. Ohio Income Tax Calculator 2021 If you make 70000 a year living in the region of Ohio USA you will be taxed 10957.

Calculate your Ohio net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Ohio paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Ohios unemployment tax rates for 2022 range from 03 to 128 depending on details like the amount of benefits paid to your former employees and total wages paid.

243 Country Lane Newnan Ga 30263 Compass

4120 Alt Rd Pacific Mo 63069 Mls 22050402 Zillow

827 Seanor Rd Windber Pa 15963 For Sale Mls 96026465 Re Max

Podcast Show Notes Game Dev Advice Gamedevadvice Com The Game Developer S Podcast

Pdf Using Universal Design For Administrative Leadership Planning And Evaluation David R Arendale Academia Edu

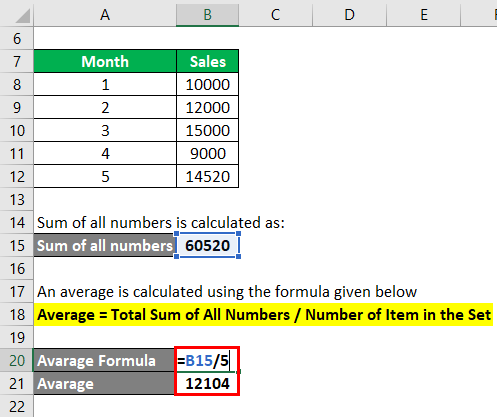

Average Formula How To Calculate Average Calculator Excel Template

Ohio Income Tax Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Houses For Rent Near Fair Choice Super Market Basavanagar Bangalore 27 Rental Houses Near Fair Choice Super Market Basavanagar Bangalore

2023 Gross Hourly To Net Take Home Pay Calculator By State

12862 Ravenna Rd Chardon Oh 44024 Redfin

22 Crescent Vw Rock Hill Ny 12775 Trulia

Kingswood Townhouses Apartments 3232 Townhouse Drive Grove City Oh Rentcafe

William Gilbert Owner Broker

6810 Tylersville Road Sibcy Cline Realtors

Chardon High School Program Of Studies 2021 2022 By Douglas Murray Issuu

Ohio Hourly Payroll Calculator Oh Hourly Payroll Calculator Free Ohio Paycheck Calculators